IPC today announced that for the second consecutive year, its Unigy® platform has won the American Financial Technology Awards (AFTAs) ‘Best Communication Infrastructure Provider’ award. This recognition is bestowed to the firm that provides the most innovative communications infrastructure to the capital markets.

“It is an honor to be recognized for the second consecutive year as the ‘Best Communication Infrastructure Provider’ in the prestigious American Financial Technology Awards program,” said Bob Santella, Chief Executive Officer, IPC. “Our Unigy platform continues to emerge as a necessity for making the trading environment more efficient and productive, and this recognition is a testament to its strength in meeting a critical industry need on a global scale.”

IPC’s Unigy utilizes the latest trading communications technologies and a services-oriented architecture to bring flexibility and scalability to financial organizations. The unified communications platform is designed specifically to make the entire trading environment more productive, intelligent and efficient. Unigy enables financial organizations to enhance IPC applications or develop their own to work on the platform, giving them greater control through a fully integrated communications solution.

Hosted by WatersTechnology, the AFTAs recognize excellence in the deployment and management of financial technology within the asset management and investment banking communities.

“Year after year, IPC has proven itself to be one of the industry’s leading solutions providers, earning the honor of ‘Best Communication Infrastructure Provider’ in the 2021 American Financial Technology Awards,” said Victor Anderson, editor-in-chief, WatersTechnology. “The company’s flagship Unigy platform has once again risen above its competitors as one of the most innovative industry technologies, and we congratulate the entire IPC team on this notable achievement.”

“Year after year, IPC has proven itself to be one of the industry’s leading solutions providers, earning the honor of ‘Best Communication Infrastructure Provider’ in the 2021 American Financial Technology Awards,” said Victor Anderson, editor-in-chief, WatersTechnology. “The company’s flagship Unigy platform has once again risen above its competitors as one of the most innovative industry technologies, and we congratulate the entire IPC team on this notable achievement.”

About IPC

About IPC

IPC is a technology and service leader powering the global financial markets. We help clients anticipate change and solve problems, setting the standard with industry expertise, exceptional service and comprehensive technology. With a customer-first mentality, IPC brings together one of the largest and most diverse global financial ecosystems spanning all asset classes and market participants. As the enabler of this ecosystem, IPC empowers the community to interact, transact and react to market changes and challenges, and we collaborate with our customers to help make them secure, productive, compliant and connected. Follow us on Linkedin and Twitter (@IPC_Systems_Inc)

About WatersTechnology

Each month, Waters reports and analyzes the practical implementation of financial technology in the wholesale banking and securities industries. Since its launch in 1993, financial IT professionals worldwide have relied on the magazine for its focused, in-depth coverage of financial market data and technology as well as the human issues of talent management, staff retention and compensation within the financial services community. With more than 10,000 subscribers, Waters readers enjoy the insights of CIOs and CTOs from the global capital markets. Waters is published by Incisive Media Plc. For more information, please visit www.watersonline.com

Certain statements contained in this press release may be forward-looking statements. Any forward-looking statements are based on current expectations, assumptions, estimates and projection and involve known and unknown risks and uncertainties. Actual results may differ materially from any future results expressed or implied by these forward-looking statements.

This recognition was determined based on anonymous employee feedback on Comparably.com over the past 12 months. These awards rank the top 50 best CEOs for large companies, and the top 50 best for small and midsize companies. To get these results, Comparably fielded over 10 million anonymous employee ratings from over 50,000 companies. See full ranking list

This recognition was determined based on anonymous employee feedback on Comparably.com over the past 12 months. These awards rank the top 50 best CEOs for large companies, and the top 50 best for small and midsize companies. To get these results, Comparably fielded over 10 million anonymous employee ratings from over 50,000 companies. See full ranking list

“Year after year, IPC has proven itself to be one of the industry’s leading solutions providers, earning the honor of ‘Best Communication Infrastructure Provider’ in the 2021 American Financial Technology Awards,” said Victor Anderson, editor-in-chief, WatersTechnology. “The company’s flagship Unigy platform has once again risen above its competitors as one of the most innovative industry technologies, and we congratulate the entire IPC team on this notable achievement.”

“Year after year, IPC has proven itself to be one of the industry’s leading solutions providers, earning the honor of ‘Best Communication Infrastructure Provider’ in the 2021 American Financial Technology Awards,” said Victor Anderson, editor-in-chief, WatersTechnology. “The company’s flagship Unigy platform has once again risen above its competitors as one of the most innovative industry technologies, and we congratulate the entire IPC team on this notable achievement.” About IPC

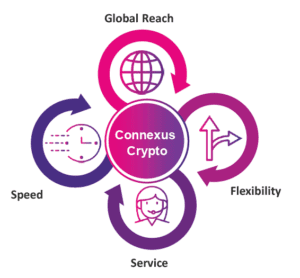

About IPC participants ahead of the competition by enabling investors to simultaneously buy and sell a cryptocurrency in different markets and take advantage of any price differences. This is possible as Connexus Crypto offers superior reliability and inter-exchange connectivity while mitigating the biggest risk to successfully exploiting arbitrage opportunities – price slippage – due to its low latency characteristics, rapid execution times and market leading reliability.

participants ahead of the competition by enabling investors to simultaneously buy and sell a cryptocurrency in different markets and take advantage of any price differences. This is possible as Connexus Crypto offers superior reliability and inter-exchange connectivity while mitigating the biggest risk to successfully exploiting arbitrage opportunities – price slippage – due to its low latency characteristics, rapid execution times and market leading reliability.