As we move on from IPC’s 50th anniversary year to embrace 2024, I can’t help but smile as I reflect on how it all came about back in 1973. In the late 1960s, after college and a stint in the Marine Corps, I started work as a systems analyst with RCA, a consumer electronics company. By 1968, when telephone network operations had been privatized in the US, I had moved to a company called Arcata Communications that had an interest in taking advantage of this opportunity. The knowledge gained from RCA and Arcata, and my certain belief that the global telecommunications industry was going to take off in a big way, led me to set up a specialist telecom consulting company which I named, rather grandly, Interconnect Planning Corporation.

My first big break came when an electronics conglomerate called Litton Industries decided to set up its own telephone company. Litton retained my services in July 1973, following a hastily convened meeting on Labor Day (a few days earlier) with my attorney, at my barber’s, to pick up the formal paperwork for the newly incorporated IPC. 50 years on, I am delighted to say I have the same attorney, although sadly not the same barber!

I was then retained by Republic National Bank, where I came up with the first trading-related solution to address the challenges of multi-line telephone boxes. Before IPC, Wall Street had only one telephone offering for trading – a mishmash of off-the-shelf components that included thousands of wires, relays, solenoid motors, nuts, bolts, and screws.

I had a different vision. One solution for this Bank was geared to the bullion market. Twice daily, a ‘fixing period’ was announced to London Bullion Market Association market makers and bullion dealing rooms. During this period, customers expressed interest to trade bullion and cross-market bids and offers were then collated across the market until supply and demand had been matched, at which point the price for gold was set and all transactions executed at that ‘fixed’ rate.

At that time only about 10% of inquiries to the Bank’s gold desk resulted in an actual trade, so I created a recording of the daily ‘London Fix’ price that could be played automatically to callers, giving access to a trader only to those callers with a genuine interest to trade. This automation immediately freed up six (of 12) traders to be deployed to other desks.

My second project involved the Bank’s ‘apprentice bankers’ – 30 or so individuals who travelled between various office locations. These employees needed to work on computer terminals when onsite, but when they weren’t, these terminals would be idle. We created a mechanism that enabled terminals to be ‘switched’ without human intervention, so that they could be used for other purposes. What’s more, we did it for $10K when another multinational technology company wanted to charge $40K!

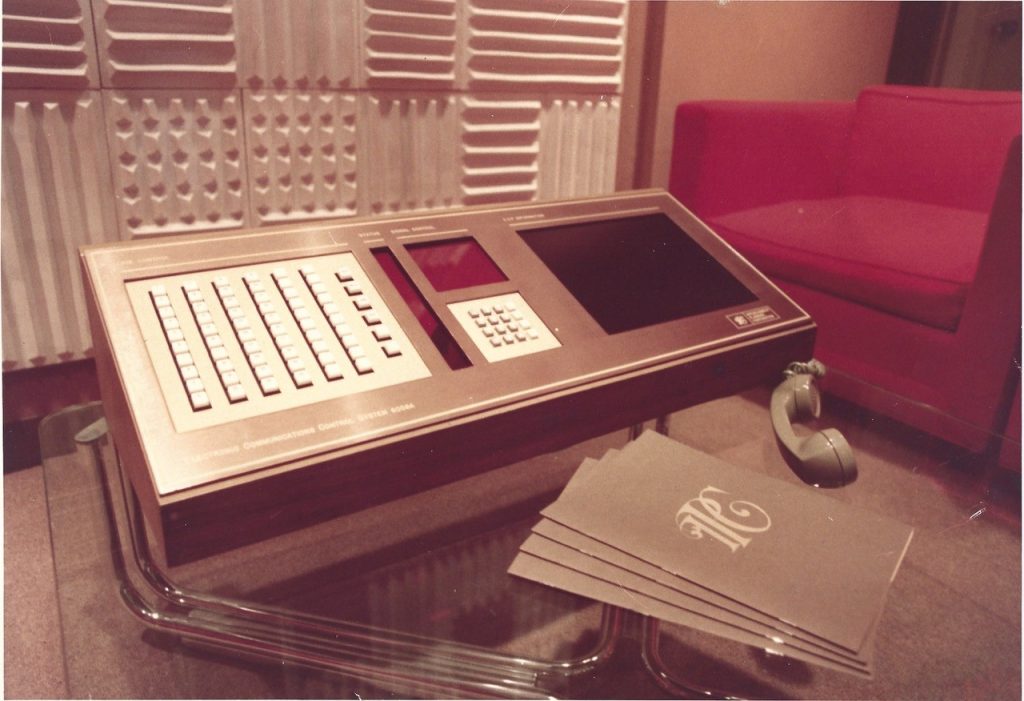

Our next challenge was the tangle of wiring required to operate multi-line telephone boxes. These typically had five live lines and a hold button but could be ‘knitted together’ in much bigger multi-line configurations. More lines meant more wires, and a 120-line ‘switchboard’ might end up with more than 1,000 individual wire connections. In the event of an issue with a line or the box itself, technicians would have to physically manipulate wires, cards and other components, which could mean switching boxes off while problems were fixed – not ideal in a live trading environment.

I intended to remove the need for 80%+ of this wiring, making it practically wireless by comparison. An artist I knew came up with an image for my vision, including a representation of how it might fit within a trading floor environment. His depiction of IPC’s new-fangled ‘turret’ looked more like a photograph which certainly helped me to pitch the idea to Republic National’s owner, Edmond Safra – along with a request for $75,000 to build the first prototype. Initially circumspect, he quickly came around to the idea, influenced in no small part, I imagine, by the US Government’s recent decision to let private citizens own bullion – and he agreed to fund the research.

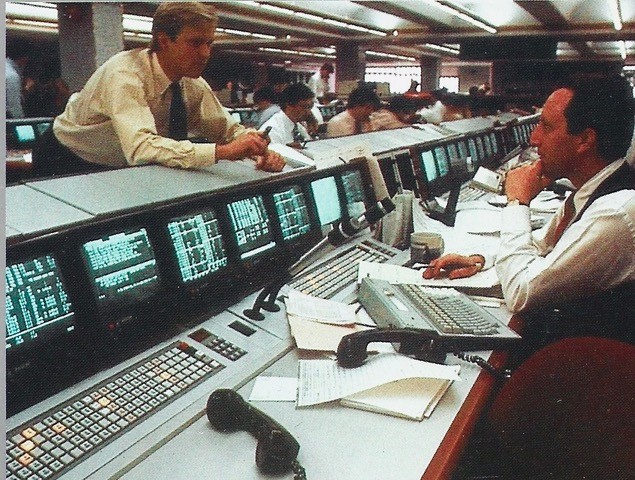

Fast forward a few years, and by 1975, Republic National was trading gold actively on IPC turrets and in pretty short order every major bank, brokerage and exchange was clamouring to install them. By the early 1980s, and to keep up with sales demand and customer support, IPC had offices in Philadelphia, Boston, Chicago, LA, San Francisco, Beverly Hills, London and Tokyo. (As an aside, customer service during this time included climbing to the 102nd and 104th floors of the World Trade Center to keep trading activity ‘live’ during frequent city-wide electricity blackouts).

There is no doubt that this simple but robust device, linked to a Control Center, with its ‘state-of-the-art’ automated functions such as “Trade Record” (a digital time stamp and voice recording of the transaction) revolutionized voice trading for banks and financial firms. So successful was the IPC turret, in fact, that Charles Wohlstetter, the then CEO of Continental Telephone (Contel), offered to pay double the stock price for IPC when it went public.

Charles was also a telecoms visionary, building up the $3 billion Contel business from a network of small rural telephone companies before selling it to GTE Corporation. A real ‘character Charles’ Wall Street career began aged 18 as a runner delivering stock and bond certificates between trading firms. He came rather late to the telephone business – aged 50 – via a diversion into Hollywood screenwriting. After our first face to face meeting at an investor event in 1981, we started to have lunch together every few months to trade ideas, and by 1983 began talking more specifically about his interest in acquiring IPC. Good to his word, he acquired it for twice its listed stock price in 1984.

IPC’s next big idea was to run fiber optic cables through the NY subway system to connect Wall Street firms with the developing “midtown” location (regular wires were not feasible due to the high voltage infrastructure). Our shareholder partner SAT (Societé Anonymé deTélécommunications) had already cabled the entire city of Biarritz in France – every house, apartment and business. Sadly, Charles stepped down and the new Contel President favored satellite technology over fiber optics so that was the end of that. However, I continued to have lunch with Charles at the Four Seasons, on the 15th of every month, until a heart attack in 1990 changed his focus.

Clearly, IPC has come a long, long way in 50 years, as financial technology has continued to advance at speed, and financial markets and services continue to evolve and grow. Today’s global financial landscape and ecosystem is a very different beast today than in 1973, and every year seems to herald the next technological innovation and revolution, from satellite communications and the Internet to cloud computing, machine learning and AI. Although I am retired to Florida to enjoy the sea and sunshine, I keep a weather eye (a nautical nod) on financial markets generally and particularly, on IPC.

I am delighted to be able to observe IPC’s continuing growth and success, and particularly proud to see that it is perpetuating the ethos of continuous financial technology innovation and exceptional customer service. My baby is all grown up – and I’m very excited to see what the next years will bring.