The normalized market data serves a broad spectrum of market participants, including- buy-side, sell-side, proprietary, and high-frequency trading firms, empowering them to enhance their trading performance.

Our solution, equipped with ultra-low latency capabilities, not only enables sell-side firms to distinguish their execution offerings for Direct Market Access (DMA) and Algorithmic Execution Strategies (AES), but it also allows customers to expedite their time-to-market. This translates to reduced application development time and a more cost-effective total ownership experience (TCO).

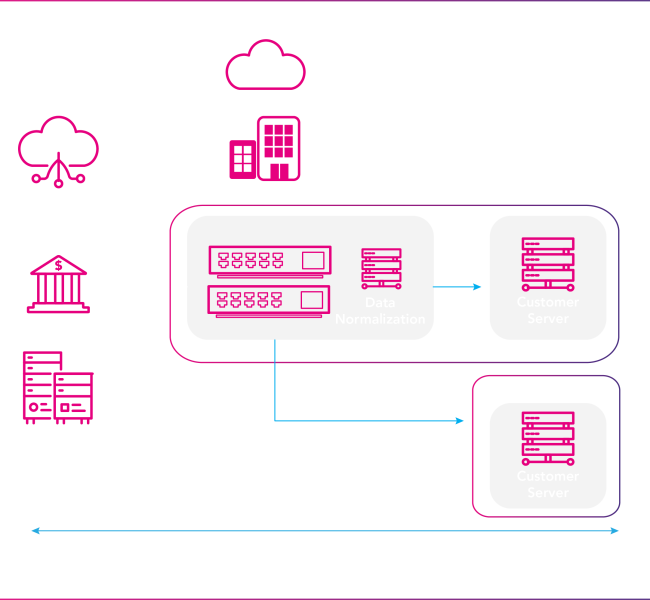

Customers co-located in the data center can cross-connect to IPC’s high-performance trading infrastructure to receive normalized data feeds with ultra-low latency.

IPC’s Data normalization service offers a comprehensive solution, correcting duplicates and anomalies to streamline data identification. Additionally, it efficiently removes unwanted data connections, prevents data deletion, and optimizes storage space.

Improves the consistency and reliability of the information.

Provides cleaner data to help better analyze and discover insights from the dataset.

Makes it easier to access and use the data more efficiently.

Expand into new markets faster, while reducing total cost of ownership (TCO).